AXLA Stock Forecast: What Investors Need to Know in 2024

Introduction

In recent years, investors have been increasingly drawn to small-cap biotech companies, with the potential for rapid growth and high returns. One such company that has caught the attention of traders and long-term investors alike is AXLA (Axovant Gene Therapies). As the biotech industry continues to evolve, the stock forecast for AXLA becomes a hot topic. With its promising pipeline of gene therapies and ongoing clinical trials, understanding the future trajectory of axla stock forecast is crucial for anyone interested in this sector.

In this article, we will dive deep into axla stock forecast analyzing its past performance, current market trends, and expert predictions for its future. We’ll cover everything from the company’s financials and clinical developments to broader market conditions that could influence the stock’s movement. Whether you’re a seasoned investor or just starting, this guide will provide valuable insights into AXLA’s potential.

Understanding axla stock forecast – Company Overview

The Genesis of Axovant Gene Therapies

Axovant Gene Therapies (axla stock forecast) is a clinical-stage biotechnology company focused on developing innovative gene therapies for the treatment of neurological diseases. Founded in 2015, the company has quickly positioned itself as a leader in the field of gene therapy, with a particular emphasis on rare and serious genetic disorders. Initially, Axovant was known for its work on Parkinson’s disease therapies but has since expanded its portfolio to address a range of other conditions, including Alzheimer’s disease and rare pediatric neurological disorders.

The company is headquartered in New York and operates globally, working with major institutions and pharmaceutical partners to bring its products to market. Its approach combines cutting-edge gene editing technology with established gene therapy delivery methods, positioning it as a frontrunner in the evolving biotech landscape.

Key Products and Pipeline

Axovant’s current pipeline is focused on a range of gene therapies designed to target conditions like Rett Syndrome, Friedreich’s ataxia, and other inherited neurological diseases. The company’s lead product, AXO-AAV-GM1, is a gene therapy targeting GM1 gangliosidosis, a rare and life-threatening genetic disorder. As of 2024, the therapy is in Phase 1/2 clinical trials, and early results have shown promise, providing the first glimpse of a potential breakthrough treatment.

Another major asset for Axovant is AXO-Lenti-PD, a gene therapy for Parkinson’s disease. While the market for Parkinson’s treatments is already highly competitive, Axovant’s approach of delivering genetic material directly into the brain could offer significant advantages over traditional treatments.

Recent Developments and Strategic Shifts

Over the past year, Axovant has made several strategic moves that have had a direct impact on the company’s stock price. In early 2023, the company completed a major restructuring to focus more intensely on its gene therapy pipeline, cutting down on unrelated research and development efforts. This move was well-received by investors, as it demonstrated a clear commitment to the company’s most promising assets.

In addition, Axovant entered into several licensing agreements with larger pharmaceutical companies, which have provided additional funding and resources to accelerate the development of its therapies. These collaborations also serve as a signal to investors that there is confidence in Axovant’s future prospects.

Financial Performance and Stock History

A Closer Look at axla stock forecast Financials

Axovant is a biotechnology company in the clinical stage, which means that it has yet to bring a product to market and, therefore, generates little to no revenue. Instead, the company primarily relies on funding through equity raises, grants, and strategic partnerships to support its operations. For investors, understanding the company’s financial health is critical, as biotech companies often face long and expensive development timelines.

As of the most recent fiscal reports in 2024, Axovant reported a quarterly loss of $30 million, which is typical for clinical-stage biotech firms. However, the company has a solid cash position of around $100 million, which should be sufficient to fund its operations for the next 18–24 months, barring any unforeseen circumstances. The company has also reduced its burn rate after its restructuring, a move that has been well-received by analysts.

Stock History: How Has axla stock forecast Performed?

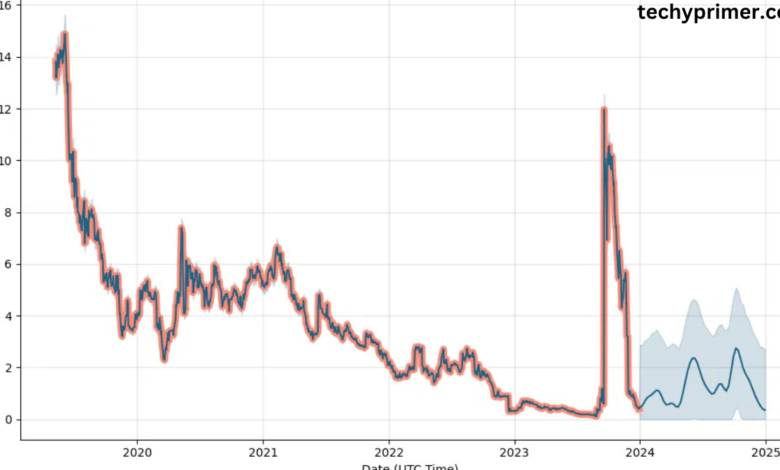

axla stock forecast has had a turbulent ride since its initial public offering (IPO) in 2015. After a strong debut, the stock faced significant volatility, with periods of sharp declines due to disappointing clinical trial results and concerns over the company’s ability to execute its ambitious plans. In 2019, the stock hit an all-time low, but the company’s shift in focus to gene therapies helped to stabilize the stock price and set the stage for its recent recovery.

In 2023, axla stock forecast saw a strong uptick in its stock price, driven by positive early-stage trial results for its GM1 gangliosidosis therapy and several strategic partnerships. However, the biotech market as a whole remains highly volatile, and even positive news can quickly be overshadowed by broader market movements or setbacks in clinical trials.

Despite these fluctuations, axla stock forecast has maintained a relatively strong position in the small-cap biotech space. As the company’s pipeline continues to mature, many analysts believe that the stock is undervalued, creating potential opportunities for long-term investors willing to stomach the inherent risks.

Volatility and Risk Factors

As with any biotech stock, axla stock forecast is subject to significant volatility, driven by the success or failure of its clinical trials. A single failed trial or adverse regulatory decision could result in sharp declines in stock prices. Investors should also be aware of the risks associated with the broader biotech sector, including changes in healthcare policy, competition from larger pharmaceutical companies, and the inherent uncertainty of drug development.

Additionally, Axovant’s relatively small market capitalization means that it is more vulnerable to market swings and investor sentiment than larger, more established companies. As a result, while the potential for significant gains exists, so does the risk of substantial losses. Investors should carefully consider their risk tolerance before making any decisions regarding axla stock forecast.

The 2024 AXLA Stock Forecast – What Experts Are Saying

Analyst Consensus and Market Sentiment

As we look ahead to 2024, analysts have mixed opinions live casino Malaysia on AXLA’s stock performance. Some believe that the company’s gene therapy pipeline has the potential to generate significant returns, while others remain cautious due to the inherent risks in clinical development. The consensus among analysts is generally positive, with a moderate to bullish outlook based on the company’s solid cash position and promising early-stage data.

In particular, the stock has garnered attention from institutional investors, who have shown increased interest in small-cap biotech companies with high growth potential. The company’s collaborations with larger pharmaceutical firms have also bolstered investor confidence, suggesting that axla stock forecast therapies are gaining recognition in the broader market.

Price Target and Key Indicators to Watch

According to the latest analyst reports, the 12-month price target for axla stock forecast is projected to be between $10 and $15 per share, based on the assumption that the company’s clinical trials will continue to produce positive results. This represents a substantial upside from its current price range of around $6 to $8 per share.

However, investors should be aware of key catalysts that could significantly impact AXLA’s stock price. These include the outcomes of ongoing clinical trials, particularly for AXO-AAV-GM1, as well as any regulatory updates from the FDA. Positive trial results and FDA approvals could lead to rapid stock price appreciation, while disappointing news could trigger sharp declines.

Another factor to watch is Axovant’s ability to secure additional funding through partnerships or equity raises. With the biotech sector still heavily reliant on outside capital, Axovant’s financial strategy will play a significant role in determining its stock performance over the next year.

Long-Term Potential: Is AXLA a Good Investment?

For long-term investors, AXLA presents both an opportunity and a challenge. On the one hand, the company’s gene therapy portfolio is in a promising space, with the potential to revolutionize the treatment of neurological diseases. If its clinical trials continue to show progress, Axovant could become a major player in the biotech field, attracting significant interest from larger pharmaceutical companies and investors.

On the other hand, the risks associated with investing in small-cap biotech stocks are undeniable. The road to approval for gene therapies is long and uncertain, and there are no guarantees that Axovant’s treatments will make it through the regulatory process. For investors willing to accept these risks, AXLA could offer substantial rewards, but it’s important to approach the stock with caution and a clear understanding of the potential for both ups and downs.

The Broader Biotech Market – Impact on axla stock forecast

The Biotech Sector in 2024

The biotech market in 2024 is in an interesting place. Following a year of turbulence in 2022, biotech stocks have shown signs of recovery, with investors becoming more optimistic about the long-term potential of gene therapies, cell therapies, and other innovative treatments. Advances in CRISPR gene editing, personalized medicine, and regenerative medicine are driving a new wave of innovation, and companies like Axovant are at the forefront of this movement.